when is capital gains tax increasing

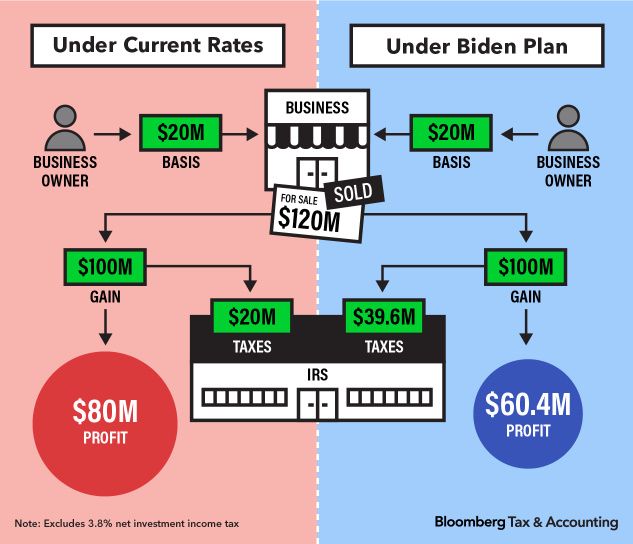

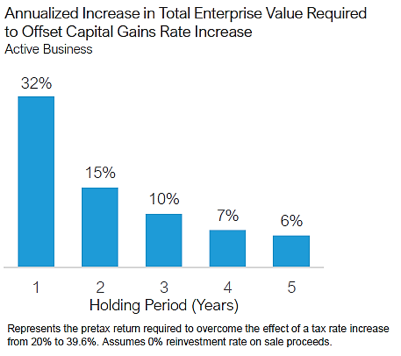

The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition. The capital gains tax is based on that profit.

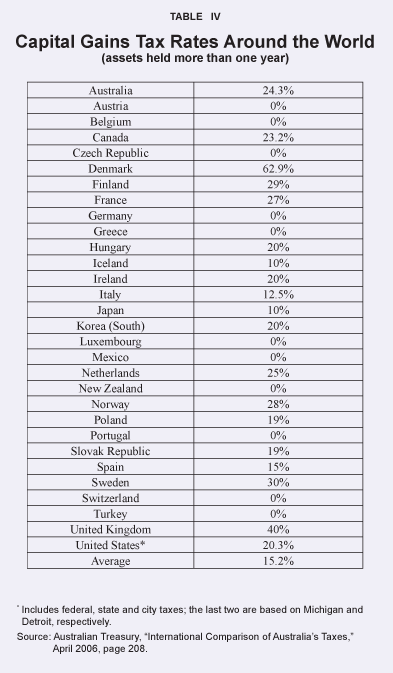

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

Three years later an actual capital gains tax was introduced at a flat rate of 30 4.

. 2 days agoProkopis Hatzinikolaou. The current long term capital gain tax is graduated. Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. This means that the first 9875 is taxed at 10 percent and the remainder in this case 25125 is taxed at 12 percent. You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451.

However since your investments pushed you into a. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. With higher standard deductions and taxable.

Its the gain you make thats taxed not the. Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

It also includes income thresholds for Bidens top rate proposal and the 38 NIIT. Currently the highest rate for long-term capital gains is 238 percent compared to a top rate of 408 percent on short-term capital gains 37 percent top marginal income tax rate. Long-term capital gains or appreciation on assets held for.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. The Finance Ministry is set to extend the suspension of the capital gains tax on property transactions as on the one hand it wants to. Assume the Federal capital gains tax rate in 2026 becomes 28.

The IRS has increased the taxable income thresholds for the 0 15 and 20 long-term capital gains brackets for 2023. The rate stayed at. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Getty Images By Rocky Mengle published 7 days ago If you sell. Again much less than the rate of tax on normal income Im not clear why.

While the current top capital gains rate is 20 the proposal will subject investors above the previously mentioned benchmark to a tax rate in line with the top income tax rate of.

Capital Gains And Tax Reform Committee For A Responsible Federal Budget

Capital Gains Tax Hike And More May Come Just After Labor Day

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

S P Stock Market Performance And Capital Gains Tax Increases Human Investing

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Figure A Increase In The Effective Capital Gains Tax Rate By Income Group Download Scientific Diagram

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Capital Gains Tax What Is It When Do You Pay It

Effects Of Changing Tax Policy On Commercial Real Estate

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

New Capital Gains Tax Increases And Home Sales Osprey Accounting Services